Should the self-employed use SEISS to pay their tax bill?

November 30, 2020 –

The third instalment of the Self-Employment Income Support Scheme (SEISS) became available from today, with the application website opening for the first group of people invited to claim.

Eligibility conditions for the scheme remain the same as in its earlier incarnations, excluding some self-employed from claiming, but for those who are eligible the extra income provided by the scheme will be very welcome.

For those whose average earnings between 2016 and 2019 were between £37,500 and £50,000 a year SEISS remains very generous. They will get the maximum £7,500 allowed under the scheme, which for some comes on top of continued earnings (albeit at a reduced level).

However, for self-employed people who are claiming Universal Credit (UC) the effect of SEISS is more ambiguous. For benefit claimants income from the SEISS counts as earnings towards their award, so the extra income reduces their UC payment.

Something like this effect is inevitable when untargeted benefits like SEISS are super-imposed on a means-tested system. But with careful planning UC claimants can minimise the effect, so that they can enjoy something like the same income boost from SEISS as better-off households.

There are two aspects to consider – when to make a claim and how to use the SEISS income.

When to make a claim

I have already highlighted the issue around the timing of SEISS claims in my previous blog on SEISS and UC but it’s worth going over the argument again.

The way UC works means the exact date money is received (and paid out) can have a big effect on entitlement. Someone claiming UC needs to know their ‘Assessment Period’, which is measured as a calendar month from the date they first claimed UC.

Let’s look at an example:

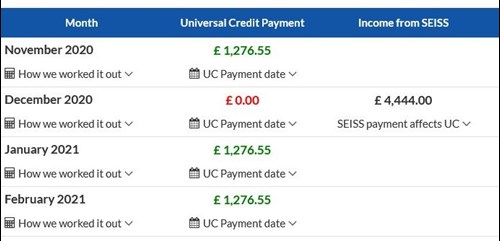

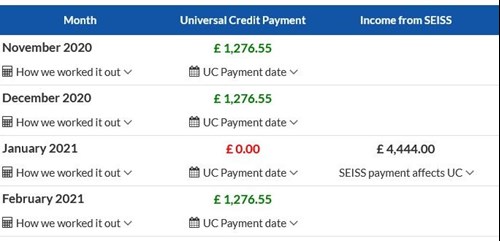

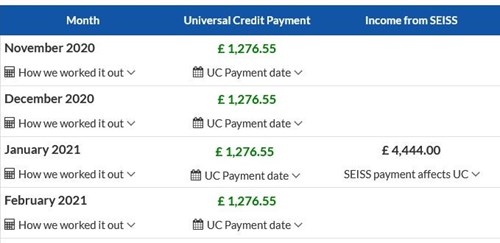

Suzanne started her claim for UC on 17 March and so her assessment period runs from the 17th of one month to the 16th of the next. She then gets paid a week later, so in this case her next UC payment would be due on 23 December.

Suzanne is eligible to claim £4,444 as a SIESS3 payment. If she puts her claim in straight away, so that it arrives in her bank account before 16 December, it will be included as income in her current UC assessment period and reduce or eliminate her award for the month.

But it doesn’t have to be that way. There is no need for Suzanne to put in a claim for the third SEISS grant until 29 January, and she will receive the same amount whenever she claims.

If instead Suzanne delays making her SEISS3 claim until 16 December, still ensuring it is paid before Christmas, receipt of the grant will fall into her following assessment period for UC. Delaying a further month will similarly shift the effect on her UC award until the following assessment period.

In general, for all self-employed people, if there is a prospect that trading conditions will improve in the new year then delaying may be worthwhile in its own right. As earnings increase many existing UC claimants will naturally lose entitlement to UC, so there will be no additional loss caused by income from SEISS.

Depending on how someone expects the unwinding of the pandemic to affect their business, delaying until the end of the claiming window for SEISS may make sense.

How to use the SEISS income

Even if someone expects their trading profits to remain reduced or eliminated for the first few months of next year, they can still take steps to protect their UC claim now.

In particular, it is well worth considering using a SEISS grant to pay a self-assessment tax bill (which, unlike the July payment, has not been pushed back from the end of January).

Just as UC takes into account income in the assessment period it is received, it also factors in business expenses in the same period. As tax payments count as a business expense for self-employed people, the timing of when a tax bill is paid can have important implications.

Back to Suzanne…

As her assessment period runs until the 16th of each month she would lose her December UC payment on 23 December if she claimed SEISS straight away. However, if she delayed and decided to use her SEISS income to pay some or all of her tax bill she will have an expense to set against this income which acts to protect her UC award.

In general, depending on individual circumstances, it may be possible to completely eliminate the effect of SEISS on UC in this way, with the tax payment offsetting all of the additional income from the scheme. Given that the deadline for tax payments is the end of January, spending a SEISS grant first to pay a tax bill, and only then on other non-business expenditure, seems a prudent approach.

The key thing to remember

If you are a self-employed UC claimant thinking about using your SEISS grant to pay your tax bill the key thing is that you get your timing right. In terms of UC it’s when money goes into and out of your bank account that really matters, so if your SEISS grant arrives at the end of your assessment period you need to be careful you make your tax payment in time.

The rule of thumb needs to be fairly broad brush but if you’ve just received your UC payment, or expect to receive it this week, then you have time to pay your tax before the SEISS affects your award. But if you expect to receive your UC towards the middle or end of the month it’s worth thinking about when to claim the SEISS.

Delaying your claim and using the money to pay some or all of your tax bill could be the best way to manage your finances and maintain your UC award. If it means smaller, or later Christmas presents, then, in this of all years, it’s likely to be a price worth paying.