Some tips for Universal Credit claimants entitled to the self-employment income support scheme

May 07, 2020 –

See our more recent blog on this topic at

Should the self-employed use SEISS to pay their tax bill?

The government’s surprise announcement that payments from the Self-Employment Income Support Scheme (SEISS) will be made early is welcome but it also has important implications for some Universal Credit (UC) claimants.

Instead of the new payment starting in June, as was previously expected, the government has now told self-employed people they can apply for the scheme from next Wednesday, 13 May, though some people will have to wait a few days longer [1]. Payments should be made within six working days, so from 21 May for people who claim on day one.

Normally the early-arrival of benefit payments is something we’d all celebrate. But for some self-employed UC claimants this one has the potential to be a mixed blessing. The problem is about timing, as the exact date that money is received (and paid out) can have a big effect on a household’s UC entitlement. It is important that claimants are aware of this interaction, as they could easily get caught out by UC’s arcane rules.

How the interaction between SEISS and UC can make a difference

To illustrate, the way SEISS affects people who claimed UC in the first week of the lockdown (week commencing 23 March) means similar households could fare very differently. It all depends on when they claimed UC and when any money from SEISS arrives.

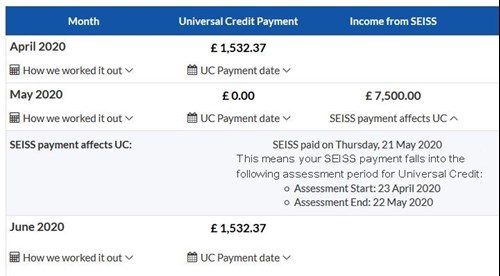

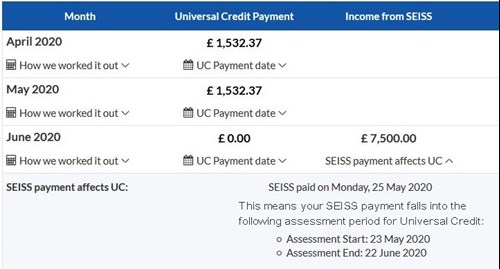

For a family claiming UC on the very first day of lockdown their first ‘Assessment Period’ (the dates used by DWP to work out monthly income) would run from 23 March to 22 April. Their second Assessment Period then runs from 23 April to 22 May and each Assesment Period thereafter would follow the same pattern.

If they apply for SEISS on the first two available days – Wednesday and Thursday next week – their payment should arrive by the 21 or 22 May and it would knock out their UC claim, as the income from SEISS is taken into account in their UC next calculation. However, if the family delayed their SEISS claim until the week after their payment it would fall into their next Assessment Period for UC and they would keep their May UC award.

As the date of claim moves so too do the key dates for when to claim SEISS. We don’t yet know if it will be possible to claim SEISS later in May or whether there is a cut-off date. However, if it is possible to claim later then the ideal timing would be to ensure that the SEISS payment arrives at the start of an UC assessment period. That way someone can take action to protect their UC claim if they might be adversely affected by losing entitlement.

Assessment Period (AP) to 22 May and SEISS payment date 21 May = SEISS received at end of AP

Assessment Period (AP) to 22 May and SEISS payment date 25 May = SEISS received at start of AP

How to try and time payments

The situation for people to avoid is a SEISS payment arriving at the end of their assessment period, a week before their UC reaches their bank account. If this occurs then the joy of the SEISS payment arriving may be reduced by the reduction (for many to £0) in their UC award.

For some self-employed people the end of May will in any case mark the point when they are able to get back to work in earnest after lockdown. For them the arrival of SEISS will coincide with leaving UC as their earnings hopefully return to something close to their previous level. In this case losing a month of UC may not matter too much. But for other self-employed people there is little prospect of returning to work and their reliance on UC could continue for many months or even years. If this is the case it’s important to get to grips with how UC works.

The way claimants communicate with DWP is via their online UC journal, where every month self-employed people have to record their exact income and expenses. In accounting jargon, UC works on a 'cash in, cash out' basis, so it’s when money arrives in and leaves someone’s bank account that counts.

The principle is the same as HMRC’s cash basis for self-assessment, which measures income and expenses from 6 April one year to 5 April the next, except that DWP looks at someone’s income and outgoings at the end of every monthly assessment period. And in the same way as the tax system, business losses can be carried forward from one month to the next. So the first thing for self-employed people to remember is to claim all their expenses every month, even if they don't have any income. Losses made now get carried forward and are set against their income from SEISS.

Is deferring July's tax bill in everyone's interest?

But the more important consideration for people is when to pay their bills, in particular their tax bills. If they can’t get their business going again in June, because of social distancing restrictions or because of the economic downturn, they need to plan their finances over a longer time period. In this case it may make sense to offset the income from their SEISS payment with equivalent expenses, so that their UC award stays around its current level.

For self-employed people who are facing a prolonged period on UC the offer to defer paying outstanding tax bills until the start of 2021 may not be that attractive, as they may not be a lot richer in January. If this is the case then using their SEISS payment to pay any outstanding tax bill could be a good way to maintain their UC claim.

It's not just the UC award that could be affected

For most people the timing of when they receive their SEISS payment will only affect their UC award. However, the consequences could be more extensive for people who have claimed a ‘Discretionary Housing Payment’, a grant from their local authority to help meet housing costs. A condition that councils must check before granting an award is that the household are receiving the housing costs element of UC for the period any DHP covers. So if someone’s SEISS payment arrives in the same month as their DHP application is assessed then the grant cannot be awarded, no matter how severe their housing need.

At the time of writing it is not clear whether a SEISS claim can be submitted later on in May. But to avoid the same situation as has arisen with people mistakenly leaving tax credits for UC, where small decisions have unexpectedly large consequences for claimants, it will be important that there is flexibility about when SEISS is claimed.

Sources