Income banded CTS: scheme details

June 03, 2019 –

Every year we research and record the range of Council Tax Support/Reduction (CTS) schemes being used by councils across the UK, so that users of our calculators can get accurate and up-to-date information about their entitlement to this benefit.

As more and more claimants are moving to Universal Credit many authorities around the country are reviewing their scheme details to make them easier to administer and fairer for their residents. As a result, recent years have seen an increase in income banded schemes being put into place.

Income banded schemes for 2019/20

After reviewing the most up to date details available for CTS schemes for all 317 Local Authorities in England we have found that 28 are running income banded schemes for 2019/20. Five of these authorities run their income banded schemes for Universal Credit claimants only.

The three main types of income banded scheme

The majority of income banded schemes fit into one of three formats.

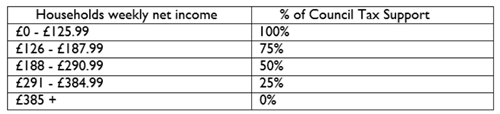

1. One set of income bands and associated reduction percentages which applies to all claimants. Example Cotswolds.

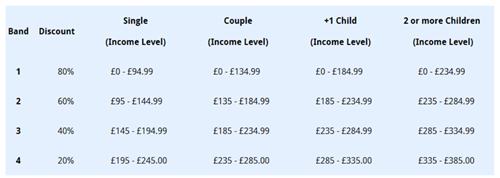

2. Four different sets of income bands and associated reduction percentages to cover four different household types; Single, Couple, Households with one child, Households with two or more children. Example Rother.

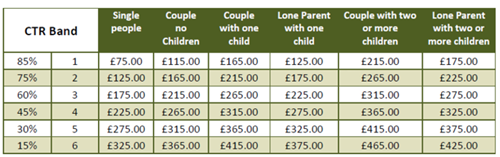

3. Six different sets of income bands and associated reduction percentages to cover six different household types; Single, Couple, Single with one child, Couple with one child, Single with two or more children, Couple with two or more children. Example Somerset West and Taunton.

The exceptions

There are two main exceptions to the above, Luton and South Cambridgeshire.

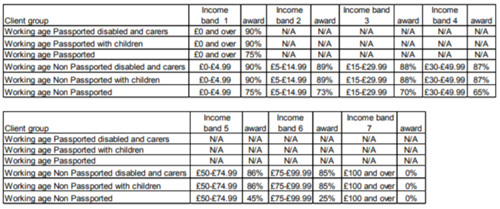

Luton’s scheme includes disabled people and carers within their household types and makes a distinction between passported and non passported claims (source).

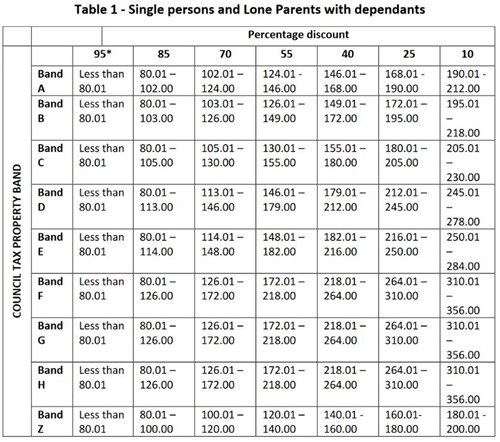

South Cambridgeshire’s scheme has two household types; Single with or without children and Couple with or without children. However, there are nine sets of income bands and associated reduction percentages for each household type, determined by Council Tax band (source).

A few other exceptions include:

St Albans - although running a scheme with one set of income bands, St Albans uses them to identify the contribution a claimant should make towards their Council Tax liability, rather than identifying a reduction percentage. As such, claimants with the same income will pay the same contribution towards their Council Tax, even if their Council Tax liability differs. It also only takes net earnings into account. Those without earnings will be placed in the lowest band.

Bexley, Luton and Manchester - these authorities stand apart in that their income bands are actually excess income bands, so their schemes retain the concept of applicable amounts. Claimants without excess income will be placed in the lowest band.

Other variances

For Universal Credit (UC) claimants there are variances in how much of the UC award itself is treated as income. Most Local Authorities are taking the UC award into account in full but some are disregarding an amount determined to be in relation to housing costs. This approach introduces the issue of creating a method in which to determine the amount of a UC award related to housing costs if the claimant isn’t receiving the maximum amount of UC.

Other notable variances lie in the treatment of non-dependant deductions and earnings disregards/additional earnings disregards, with many taking a blanket policy approach to these, either removing them completely or setting a flat rate.

Some schemes retain policy options common within ‘standard’ schemes such as band caps and capital limits and others have stripped the schemes right back to let the income bands do the work.

|

This blog provides an overview of the types of income banded schemes now in use. You can also watch a video of our webinar, recorded on 18 June 2019 and run in conjunction with the New Policy Institute. Do get in touch if you have any follow on questions about our research. |