£15+ billion unclaimed means-tested benefits – but the sketchy take-up data makes it hard to say for sure

January 05, 2021 –

Happy New Year to everyone in the welfare world from all of the team at entitledto! We hope you had a restful break over the Christmas holidays.

As a time for reflections, the start of 2021 saw the numbers nerds in our (home) office mulling over the whereabouts of the latest government data on the take-up of income-related benefits so we could publish our annual blog on the issue.

But after a little hunting and gathering we quickly realised a further part of the data had not been released and so, again, our task of independently, accurately and reliably reporting on the situation has become even trickier.

This is because, over the past eight or so years, as the responsibility for the administration of various benefits has moved between central and local government as well as between different government departments, there hasn’t been one source of data on benefits take-up. We therefore needed to gather the relevant facts and figures from a range of reports published by both the DWP and HMRC, and, as time passes, the quantity of overall data made available by both departments has reduced.

The result we’re unfortunately left with is that the new take-up statistics raise more questions than they answer.

This year’s change is that data for the take-up of tax credits are no longer produced but, as in the past few years, we are still waiting for the statistics on Universal Credit, some seven years after the new benefit was introduced. Last year the DWP told us the “situation is being monitored and changes will be made in future as required” but, as was the case a year ago, we’re still waiting.

Even more frustratingly, statistics on the take-up of help for Council Tax were stopped in 2013 (covering the 2009/10 financial year), when responsibility was moved to local authorities. This means we know nothing about under-claiming of this benefit (although anecdotal evidence suggests take-up of Council Tax Reduction is much lower than it used to be under the national scheme, for example see footnote [i] below) and it doesn’t look like the data will be made available again any time soon.

So what do we know from the data that does exist?

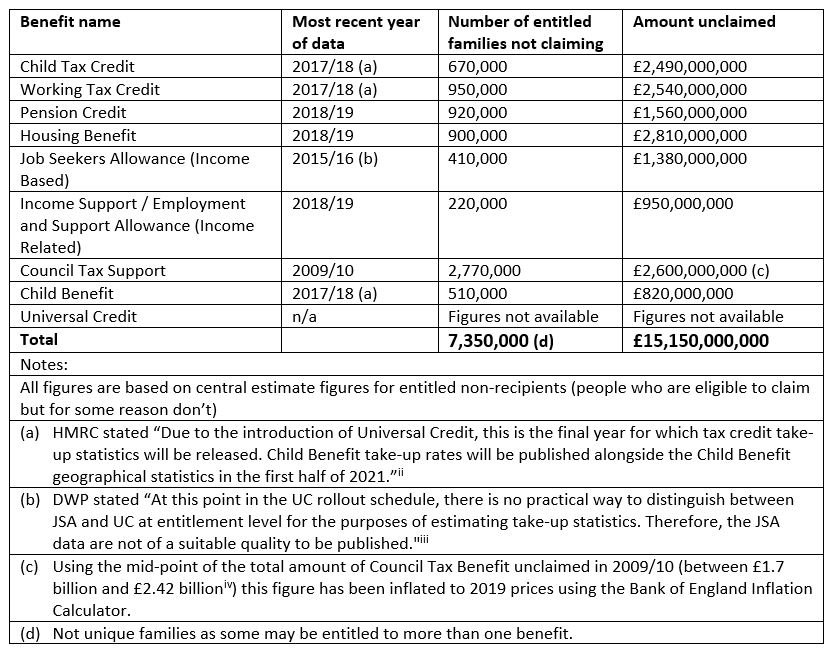

Using the best data we can find (see table below), we believe over £15 billion is being unclaimed by low income households across the UK. This means millions of our poorest families, young people and old people, disabled people, job searchers and workers are not getting the help they are entitled to.

Is that better or worse than previous years?

On paper things look better, as last year we reported £16 billion went unclaimed, but I’m sure you won’t be surprised that due to the sketchy statistics we really can’t reliably tell.

Let’s just hope we’re in the position to paint a clearer picture about this next year.

Where the total £15 billion figure comes from:

We must surely get a gold star for getting this far into the blog before mentioning the words coronavirus and pandemic! However, we did want to say, although the estimates used in this blog are the most recently released, the latest year covered is 2018/19 meaning it’s all based on pre-pandemic data.

Future take-up data may reflect this year being a time when many turned to the state for support for the first time. And one consequence of coronavirus is a raised awareness of the pros (although also the cons) of the welfare system in our country, meaning – hopefully – some of the missing millions have been reached.

But, please still help us encourage everyone to check if they are entitled to claim benefits, now!

Our free tools are here to help people quickly work out what support they may be entitled to. The pandemic means our annual plea is even more important than ever, so please share them with friends and family so they can check what help they may be able to claim.

Sources:

[i] https://www.gov.scot/publications/council-tax-reduction-scotland-annual-report-2018-19/pages/2/